I've been into investing for a number of years. Of course, I can't afford to save much, but I save as much as I possibly can. It's actually over 10% of my paycheck when you add all of the pieces up.

About 10 years ago, I opened an account at Sharebuilder, a local online brokerage firm that I looked at and decided to support with my business. It was easy, but the amount of money I had available was really low. They didn't mind. Over the next 4 years, I slowly added a small amount of money each month, sometimes skipping several months when things were tight. Then in early 2004 I had a CD mature, and I put a thousand dollars into AT&T, right when it was merging with Southern Bell. I started getting significant dividends from that. Ok, "significant" for me. Most people wouldn't consider these numbers to be that impressive. But it got me thinking.

I opened an account for each of my sons, and started saving a little bit into those. I got hit hard when Shea's biggest stock, GM, went under. But whatever. That's the market. It was also nice when Microsoft started paying dividends.

I kept coming back to dividends. I know that there were stories coming out of the Great Depression that the stocks where the price had collapsed kept doing business, kept making profits, and kept paying dividends. A modest investment made in the late 20's, if the investor didn't get cold feet, came up to quite a revenue stream in the 1980's by reinvesting their dividends every quarter.

Then Google launched Google Finance. I'd been using Yahoo Finance for a while to track things, but they stopped trying to expand their service and I moved away from them. Google put up dynamic charts where I could see what the trends have been, and what the dividends had been. New research tools gave new ways of seeing the same data that I remember my grandfather pouring over as I was growing up. Then I heard about something else. Monthly stock dividends.

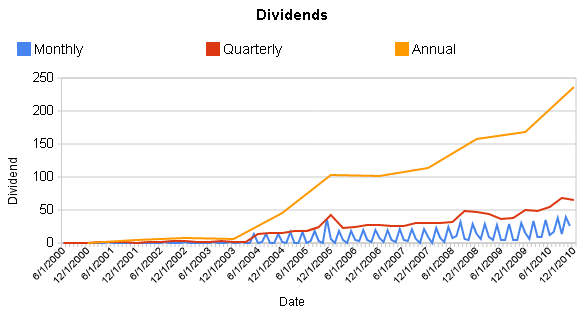

There are quite a few companies, or exchange traded funds, that pay their dividends not on a quarterly basis, but monthly. This increases the compounding quite substantially. So I started looking for them. I found some lists, combined them, filled in the blanks, looked at the calculations for dividend yield and return, and started coming up with a plan. I still didn't have a whole lot of money to play with, but I decided to play with what I had. So I came up with a plan.

The trick was to stop looking at the account balance and the stock price. If you're going to invest for dividends, you are going to be holding on to the stock. And when I really started studying and planning, we had just entered the latest downturn in the market where stock prices were going down into Davy Jones Locker. But a lot of them were still doing business, still making profits, and just like during the Great Depression still paying dividends. Even the monthly dividend stocks didn't skip that much. Maybe a month here or there, maybe an adjustment downward, but they didn't stop paying. There are right now over 400 stocks that pay dividends on a monthly basis.

What I eventually landed on was a snowball scheme. I say scheme because it's a fun word to use. Makes people think of shady secrets and exclusivity. It's not. It's just a word. Here is how it works.

Say you have 3 stocks. AAA, BBB and CCC. Each one pays a dividend, each one has a price. Say they all pay their dividend monthly.

| Stock | Dividend | Price | Frequency |

|---|---|---|---|

| AAA | $0.10 | $10.00 | 12 |

| BBB | $0.08 | $12.50 | 12 |

| CCC | $0.15 | $25.00 | 12 |

From this data we can calculate the Calculated Yield.

| Stock | Dividend | Price | Frequency | Calculated Yield |

|---|---|---|---|---|

| AAA | $0.10 | $10.00 | 12 | 12.00% |

| BBB | $0.08 | $12.50 | 12 | 7.68% |

| CCC | $0.15 | $25.00 | 12 | 7.20% |

This is actually fairly typical. The range of dividend yields on my list of monthly dividend stocks averages between 6% and 7%.

I set my goal as earning $100 in dividends per year from as many stocks as possible. So we need to add a few more columns to the table.

| Stock | Dividend | Price | Frequency | Calculated Yield | Shares to earn $100 per year | Shares needed | Money needed for $100 per year |

|---|---|---|---|---|---|---|---|

| AAA | $0.10 | $10.00 | 12 | 12.00% | 83.33 | 83.33 | $833.33 |

| BBB | $0.08 | $12.50 | 12 | 7.68% | 104.17 | 104.17 | $1,302.08 |

| CCC | $0.15 | $25.00 | 12 | 7.20% | 55.56 | 55.56 | $1,388.89 |

So, what do we do with all of this? These random number examples show that in order to collect $100 from stock AAA, we need to purchase $833.33 worth of stock to buy 83.33 shares. In Sharebuilder, you can set automatic deposits, and automatic investments costing $4 each. Once you get the first one, you simply change the stock you want to buy to BBB, and go from there. You can do this with the Blue Chips, you can do it with Renewable Energy Stocks, or any other type of stock list.

Can this work? You tell me:

3 comments:

Your blog talks about "taking back America one stock at a time".

Can you explain that further?

I think that publicly traded companies that operate in America should be owned by the American People. I think we would be better off as a country if we had a stake in the gains and losses that we see in the stock market. And maybe we would have an influence on the decisions these companies make, from Board of Directors elections to Shareholder Resolutions. I don't believe in giving up power by letting other people own stock and make all the decisions. What we want to do within the political sphere I also think we could do within the economic sphere.

That's an interesting idea.

It think it would also be helpful if more Americans were bondholders. Bondholders seem to have more power these days than stockholders.

Post a Comment