Thursday, November 18, 2010

Just joining the workforce? Start saving NOW!

25 years. Wow.

Now, that's assuming a lot, like you don't get a raise or change jobs, that your finances are strong enough throughout that time period so you don't have to reduce how much you are saving, and that you stay on top of your investments to make sure that you are always getting at least 10% out of them.

The first assumption is actually a good thing. Most people earn more and more over their working lives as their wages go up or they find better jobs.

The second assumption is not as big as you think. Most employers make it pretty easy to save money out of your paycheck so you don't ever see it and so you can learn to live without it. But nobody goes through life without having some kind of problem that results in stopping or slowing your savings rate.

The third assumption is the hardest. It's not impossible to earn 10% in dividends or interest, but in any market situation it's not easy either. You have to keep an eye on what you are getting and make adjustments on the fly, day by day. I have a list of hundreds of stocks that pay dividends monthly, but only around 30 pay higher than 10%. And those that do might not keep doing so over a long period of time. Constant vigilance.

How are you doing in your savings plan?

Friday, November 05, 2010

Dividend Snowball Investing

I've been into investing for a number of years. Of course, I can't afford to save much, but I save as much as I possibly can. It's actually over 10% of my paycheck when you add all of the pieces up.

About 10 years ago, I opened an account at Sharebuilder, a local online brokerage firm that I looked at and decided to support with my business. It was easy, but the amount of money I had available was really low. They didn't mind. Over the next 4 years, I slowly added a small amount of money each month, sometimes skipping several months when things were tight. Then in early 2004 I had a CD mature, and I put a thousand dollars into AT&T, right when it was merging with Southern Bell. I started getting significant dividends from that. Ok, "significant" for me. Most people wouldn't consider these numbers to be that impressive. But it got me thinking.

I opened an account for each of my sons, and started saving a little bit into those. I got hit hard when Shea's biggest stock, GM, went under. But whatever. That's the market. It was also nice when Microsoft started paying dividends.

I kept coming back to dividends. I know that there were stories coming out of the Great Depression that the stocks where the price had collapsed kept doing business, kept making profits, and kept paying dividends. A modest investment made in the late 20's, if the investor didn't get cold feet, came up to quite a revenue stream in the 1980's by reinvesting their dividends every quarter.

Then Google launched Google Finance. I'd been using Yahoo Finance for a while to track things, but they stopped trying to expand their service and I moved away from them. Google put up dynamic charts where I could see what the trends have been, and what the dividends had been. New research tools gave new ways of seeing the same data that I remember my grandfather pouring over as I was growing up. Then I heard about something else. Monthly stock dividends.

There are quite a few companies, or exchange traded funds, that pay their dividends not on a quarterly basis, but monthly. This increases the compounding quite substantially. So I started looking for them. I found some lists, combined them, filled in the blanks, looked at the calculations for dividend yield and return, and started coming up with a plan. I still didn't have a whole lot of money to play with, but I decided to play with what I had. So I came up with a plan.

The trick was to stop looking at the account balance and the stock price. If you're going to invest for dividends, you are going to be holding on to the stock. And when I really started studying and planning, we had just entered the latest downturn in the market where stock prices were going down into Davy Jones Locker. But a lot of them were still doing business, still making profits, and just like during the Great Depression still paying dividends. Even the monthly dividend stocks didn't skip that much. Maybe a month here or there, maybe an adjustment downward, but they didn't stop paying. There are right now over 400 stocks that pay dividends on a monthly basis.

What I eventually landed on was a snowball scheme. I say scheme because it's a fun word to use. Makes people think of shady secrets and exclusivity. It's not. It's just a word. Here is how it works.

Say you have 3 stocks. AAA, BBB and CCC. Each one pays a dividend, each one has a price. Say they all pay their dividend monthly.

| Stock | Dividend | Price | Frequency |

|---|---|---|---|

| AAA | $0.10 | $10.00 | 12 |

| BBB | $0.08 | $12.50 | 12 |

| CCC | $0.15 | $25.00 | 12 |

From this data we can calculate the Calculated Yield.

| Stock | Dividend | Price | Frequency | Calculated Yield |

|---|---|---|---|---|

| AAA | $0.10 | $10.00 | 12 | 12.00% |

| BBB | $0.08 | $12.50 | 12 | 7.68% |

| CCC | $0.15 | $25.00 | 12 | 7.20% |

This is actually fairly typical. The range of dividend yields on my list of monthly dividend stocks averages between 6% and 7%.

I set my goal as earning $100 in dividends per year from as many stocks as possible. So we need to add a few more columns to the table.

| Stock | Dividend | Price | Frequency | Calculated Yield | Shares to earn $100 per year | Shares needed | Money needed for $100 per year |

|---|---|---|---|---|---|---|---|

| AAA | $0.10 | $10.00 | 12 | 12.00% | 83.33 | 83.33 | $833.33 |

| BBB | $0.08 | $12.50 | 12 | 7.68% | 104.17 | 104.17 | $1,302.08 |

| CCC | $0.15 | $25.00 | 12 | 7.20% | 55.56 | 55.56 | $1,388.89 |

So, what do we do with all of this? These random number examples show that in order to collect $100 from stock AAA, we need to purchase $833.33 worth of stock to buy 83.33 shares. In Sharebuilder, you can set automatic deposits, and automatic investments costing $4 each. Once you get the first one, you simply change the stock you want to buy to BBB, and go from there. You can do this with the Blue Chips, you can do it with Renewable Energy Stocks, or any other type of stock list.

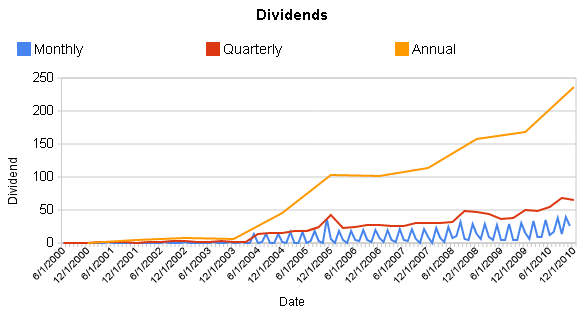

Can this work? You tell me:

Wednesday, November 25, 2009

Ideas for Seattle

Create a way for citizens to buy municipal bonds at $100 denominats

Neighborhood Endowment Funds

If you live in Seattle, please help me get the votes to get these ideas on the top of the priority list!

Wednesday, February 18, 2009

I'm not a mortgage expert

I've rented apartments and houses, but never gone into a mortgage. I've never had the income necessary to make that a reality, so I've never tried. When I moved into my wife's condo, she had already paid off her mortgage, and we don't plan to move. So I don't have to dig into the mess personally. But because this is part of the core to why my community is in trouble, I still want to talk about what I know.

What I have seen and read about how the housing market has worked over the last 30 years has taught me that our system is fundamentally broken. In the 1950's and 60's, people had good jobs that paid a living wage. You got a job that you expected to have for a long time, maybe even your entire career. You signed into a mortgage agreement with a bank, and paid the mortgage off over 30 years. I don't know if the rates were flat or variable, but they were paid because people could afford them. The housing market was pretty stable at that point.

In the 1970's and 80's, we started seeing a concentration of wealth. This gave bankers and investors the ability to start to influence things like wages, through fights against unions and the search for higher profits that cut our ability to maintain high wages and high standards. In the 90's, the drop in incomes started to affect the housing market, and lawmakers started looking at the problem. But because conservatives controlled Congress, the solution that they moved towards was designed to help the banks and investors more than the people trying to own homes. There was a fundamental choice involved, whether to increase wages so that people could again afford homes in the community, or by lowering the standards and allow people who fundamentally could not afford a mortgage get into one anyway. Interest only loans, no money down, lower initial interest rates, and other attempts to make it possible for lower incomes to be able to sign paperwork that was against their best interest. It took a few years for the rot to start to stink. Here we are. I'm not even going to go into the investment games that sliced these mortgage agreements up and sold them on the stock market promising investors high interest rates until the cows come home.

President Obama is right when he says that we have to do something about this. People shouldn't be punished for trying to create a stable home for their children. But someone earning a minimum wage can't afford to pay $1,500 or more every month on a mortgage for a home that they shouldn't have signed for in the first place. What can they afford? The minimum wage in Washington State is $8.55 per hour. Assuming 8 hours a day and four weeks per month, that gives a monthly gross income of $1,368. According to this calculator that I found, and given a flat 5% mortgage interest rate which might be unreasonably low, the monthly payment on the loan would be $383.04, and the affordable home amount is $72,353.31. I don't know any home in my area worth that little, or if it is would it be worth living in? I don't know.

If we adjusted home values to allow people to afford things like this, there might be a huge drop in home values, which is likely why the conservatives tried to lower the standards rather than increase wages or lower home values, which really should be a market rate in the first place.

So, what do we do?

The first thing we really need to do is establish a foundation, and then stand on principle. I believe that our standards for buying a home should be high. It's important, because we need stability. So let's start with these three principles:

1. 10% - 20% down payment on the loan.

2. Monthly payments should not be more than 33% of montly gross income.

3. The rate of the mortgage should be a flat rate for the life of the loan.

Here are the problems with these principles as I see it. Not very many people working today would be able to put forward 10-20%. Not many homes are a low enough value to allow people to limit their housing expense to 33% of their monthly income. And variable interest rates are popular to banks because the inter-bank loan rate is variable, allowing them to adjust things to fit circumstances so they can maintain their profit margin.

The solutions to these problems are actually pretty simple. Raise wages, both by increasing the minimum wage and by providing and encouraging jobs so that people can afford to save for a down payment and afford a better home. Stop using the Federal rate as a yo-yo to try and manage the economy. Instead, focus on building a solid foundation and then building on that foundation. The foundation of our country is a strong middle class, with good paying living wage jobs that last for years. It's a good education that opens doors of opportunities and expands industries into new technology and resource bases. Change our monetary policy to build an economy on a foundation of wealth instead of a foundation of debt.

Gee, where have we heard this before?

Tuesday, December 09, 2008

TWX Reverse Stock Split

I voted yes. What the heck.